About The Volatility Engine™

Our Mission

Markets move fast. Traders face an overload of noise, conflicting signals, and uncertainty around when to act.

The Volatility Engine™ was built to solve this problem by delivering real-time, regime-aware decision support that surfaces only the highest-confidence opportunities — and filters out everything else.

Our mission is simple:

Profit by Design. Master the Moment.

The Flagship: SPX Volatility Engine (SVE)

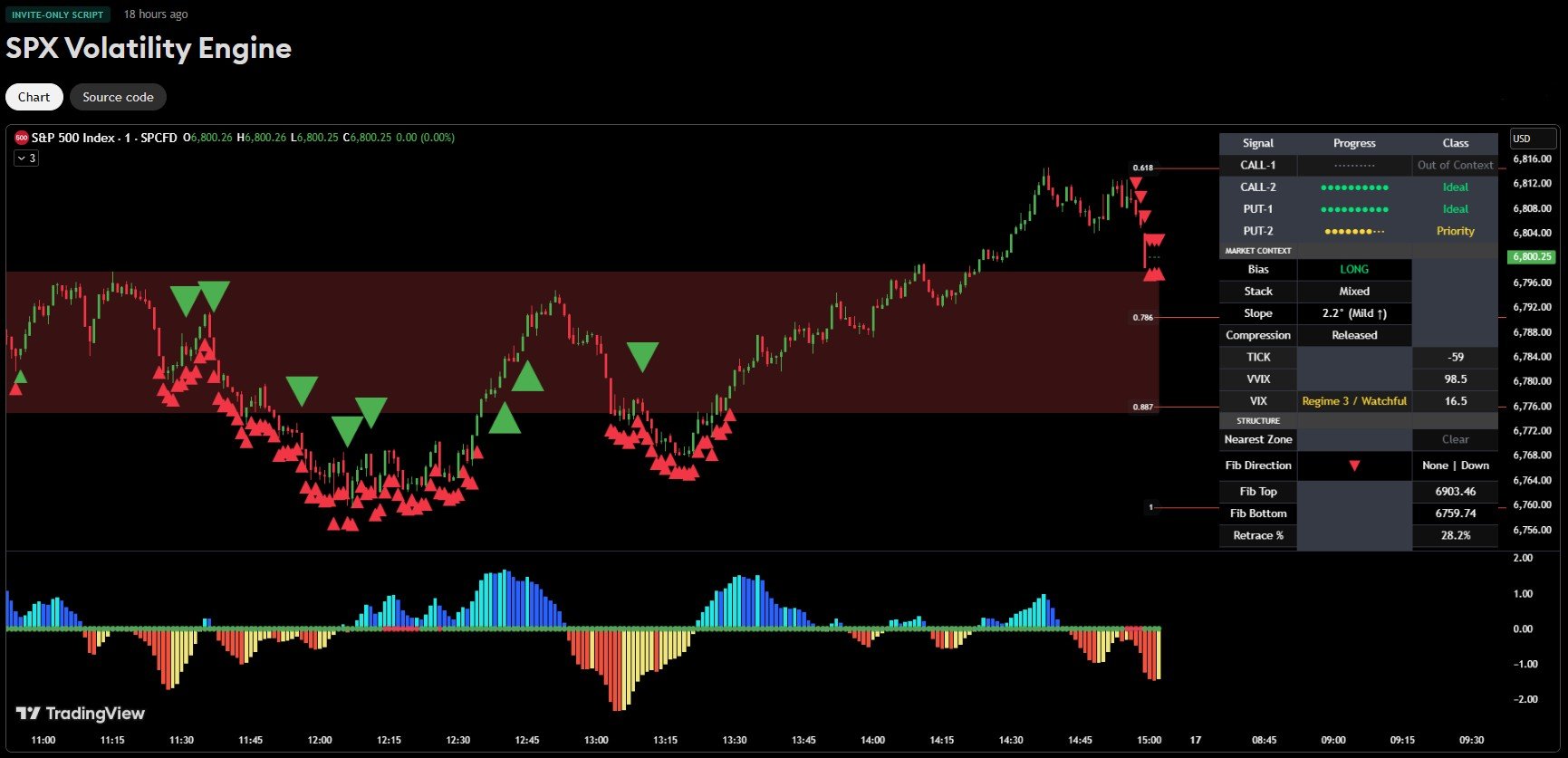

The SPX Volatility Engine (SVE) is the first and flagship product in The Volatility Engine™ line. Built for SPX traders who demand clarity in the most dynamic, high-leverage market in the world, SVE transforms volatility into structure — enabling disciplined, confident decision-making in real time.

SVE integrates:

Regime Awareness – adapts dynamically to shifts in market conditions so traders know when to press and when to protect.

Signal Scoring – filters opportunities into Ideal, Priority, or Out-of-Context for clear trade selection.

Structural Context – overlays zones, ratios, and structural reference levels to frame directional bias.

Real-Time Delivery – provides actionable context on a 1-minute SPX chart, updating bar-by-bar as conditions evolve.

The result is a tool that does more than generate signals — it frames the decision-making environment, bringing structure to volatility and clarity to execution.

SVE is now available on TradingView under invite-only access for qualified traders.

The Roadmap

The Volatility Engine™ is more than one tool. Our vision is a family of decision-support systems across multiple markets — each built on the same principles of quantified logic, volatility adaptation, and structural awareness.

Products currently in development:

NQ Volatility Engine – built for NASDAQ-100 traders.

ES Volatility Engine – focused on S&P 500 futures.

Crypto Volatility Engine – applying regime-based logic to dynamic digital asset markets.

Every engine follows a common philosophy:

cut through noise, adapt to real conditions, and support confident execution.

Our Commitment

At The Volatility Engine™, our commitment is to build tools that empower traders rather than automate them.

Every product we release is:

Quantified – grounded in measurable structure, statistical logic, and real-market behavior.

Transparent – with clear classifications and context, not black-box alerts.

Actionable – designed for real-time decisions where clarity matters most.

Disclaimer

The Volatility Engine™ is a commercial analytics platform available through TradingView. It is not investment advice. SPX options are highly leveraged and risky — trade small, stay disciplined, and focus on process.

Live SPX Volatility Engine view during market hours.